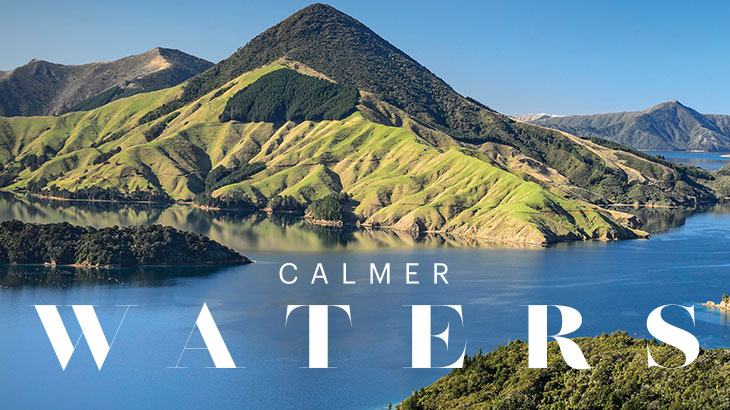

Calmer waters

As the world adjusts to an altered reality in the wake of a global health response, waterfront property is resonating with those seeking a sense of calm and a lifestyle to match.

As the world adjusts to an altered reality in the wake of a global health response, waterfront property is resonating with those seeking a sense of calm and a lifestyle to match.

When New Zealand went into full lockdown making beaches, lakes and rivers effectively out-of-bounds with no water sports or recreational fishing, a collective sigh echoed around the country.

How lucky were those who had made a waterfront property their permanent home with those soothing water views providing respite from the chaos that was unfolding around the world.

The value we place on living or staying near the water has been amplified in 2020, with a significant rise in enquiry in waterfront property for sale, and coastal and other waterside destinations popular now that domestic tourism has opened up and overseas is off-limits.

New Zealand’s internationally-lauded health response throughout the global COVID-19 pandemic has resonated with expats who have started gravitating back to our shores with others investing in a property to return to once borders are more relaxed.

Our “safe haven” status has contributed to positive net migration figures for the first time in a long time and this has fuelled the property market, with the waterfront sector finding enhanced appeal.

Knight Frank, Bayleys’ global property partner, says British homebuyers are paying 46 percent more, on average, to live near a body of water, with values reaching new heights during the ongoing pandemic challenges and restricted travel measures.

In New Zealand, waterfront property is often an intergenerational investment – with a real focus on the memories that will be created there.

Waterfront checks in with Bayleys’ teams around the country to see what’s changed in the waterfront market in 2020 and talks to a London-based family who purchased a coastal property sight-unseen during lockdown.

Sounds great

Bayleys Marlborough managing director Glenn Dick says the pandemic has intensified interest in waterfront property in the Marlborough Sounds.

“Everybody wants their own piece of paradise and while it may have been in the dream basket prior to COVID-19, there’s now a sense of ‘what are we waiting for’.

“People want space, they want freedom, they crave being near the water and here in the Sounds, we can add ‘affordable’ to that want list.

“There’s not many places in New Zealand where you can buy a piece of waterfront action for $400,000-$700,000, but if you look at the Sale Snapshots section in this edition of Waterfront magazine, you’ll see that many of the Marlborough sales fall into this bracket.”

The Marlborough Sounds is also one of the few areas in New Zealand where much of the property for sale can only be accessed by water, says Dick.

“Surprisingly, this is not a handbrake and in fact, is often the very reason people choose to buy in the Sounds.

“The remoteness is what sets it apart and adds to the ‘retreat’ feel of owning a waterfront holiday home or permanent base.

“Most of the properties are easy to get to with a moderately-sized boat and the water taxi services are reliable and regular around here.”

Expat enquiry has increased in the past six months – along with heightened interest from New Zealanders.

“One of the more remote properties we had for sale got 52 email enquiries, while another was bought sight-unseen from a Kiwi based in the UK.

“He’d earlier missed out on a couple of properties so made a show-stopping offer to make sure he secured something to ultimately Dcome back to.”

Coromandel gold

Bayleys Coromandel managing director Mary Walker, says as soon as a waterfront property is listed in the Thames-Coromandel catchment it’s snapped up, with every property under contract within a month.

“That’s a hot market and a shortage of stock is driving prices up.

“Prices in the district are ramping up, too, with recent realestate.co.nz data confirming a year-on-year increase in asking prices of around 27 percent.”

Walker says bare land canal-front lots within stage 12 of the Whitianga Waterways precinct sold down in record time and the secondary market for canal-facing property is also robust.

“That’s the beauty of the Coromandel property market – there’s the whole spectrum from old-school Kiwi beachfront baches to opulent homes on the canals.

“There’s a ready market for anything near the water, with a strong nostalgic component at play.”

“Enquiry we have received from offshore buyers is largely skewed towards the second home market, with a tangible and sentimental pull back to the area.

“The majority have holidayed here as children and are wanting to recreate that lifestyle for their own families.”

Walker says properties on the waterfront at Cooks Beach, Hahei, Whangamata, Pauanui and Tairua still command a high premium, but for those with under $1 million to spend, one spot remains undervalued.

“Thames offers affordability, accessibility, schooling and a hospital, and the convenience that some of the other waterfront places can’t deliver.

“It’s just over an hour from South Auckland so you could feasibly live in Thames and work in Pukekohe, with an affordable waterfront lifestyle.

“Thames is also appealing to retirees as they can sell up in Auckland, buy in Thames and enjoy a good life with money to spare.”

The drift north

Enforced pandemic lockdowns gave people plenty of time to think about where and how they want to live, says Bayleys in the North director, Mark Macky.

“That introspection has translated into fast-tracked action across our waterfront markets and like many parts of the country, our inventory levels are the lowest they’ve ever been.

“Across the whole market we have 30 percent fewer listings than this time last year and that is certainly amplified with waterfront property specifically and the demand is strong.”

Macky says while offshore, particularly expat, enquiry levels are very strong, we shouldn’t underestimate the ability of local Kiwis as the best buyers for waterfront property.

“There’s a large pool of people who, under normal circumstances, would be travelling and spending significant amounts overseas but have opted to redirect that money into a tangible asset here.

“With negligible term deposit returns and mortgage interest rates forecast to hit sub-2 percent in the not too distant future, property not only makes sense but is a compelling proposition.

“Not so long ago, the interest on a $1 million mortgage was around $60,000 per annum. It could be under $20,000 early in 2021, and if you take into account potential for capital gains in the coming few years this is creating plenty of fuel for the fire of purchaser demand.”

Add in the capacity for remote working – and waterfront property clicks up another few notches.

“People now appreciate that they can work from anywhere as long as there’s a robust internet connection.

“That applies to expats still domiciled offshore and they’re exploring options with new-found passion, accepting that they don’t need to be overseas – or even in Auckland for that matter, to make life work.”

Macky says some have already taken the plunge and committed to a waterfront property in the north.

“One expat client was working in a corporate role in Melbourne and was told they won’t be working back in the office for the next 12 months. They’ve moved to Mangawhai for the next 12 months and are now enjoying a daily walk on the beach instead of being locked in their house.

Macky co-owns 10 Bayleys’ offices north of Auckland and says while there’s been a noticeable uptick in activity across each of those markets, some are going absolute gangbusters.

“Mangawhai and Langs Beach are flat out, the Bay of Islands remains buoyant, and anything in the Matakana Coast or in Omaha is seeing huge demand.”

Read more...

[Download PDF guide]