The piste de résistance

Global research shows property in ski resort towns has soared in popularity and value in the pandemic’s wake – so how has New Zealand’s alpine market fared?

Total Property - Issue 5 2022

Bayleys’ global real estate partner Knight Frank recently released its Ski Property Report 2022 looking at property conditions in the world’s top ski destinations.

Focusing on resort towns in the French and Swiss Alps, St Moritz in Switzerland leads the Knight Frank Ski Property Index with price growth nudging 17 percent on an annual basis.

Tight supply was responsible for this growth in value, as mainly Swiss-domiciled buyers battled to secure property in St Moritz while international tourists were unable to visit due to lockdowns.

Having reassessed life priorities, and embracing remote working, winter sports enthusiasts have flocked to resort towns to buy property either as a permanent, or secondary residence.

It’s a trend being noted in New Zealand too, with the alpine towns of Queenstown and Wānaka picking up speed in the past couple of years, according to William Wallace, general manager Bayleys South Island commercial and industrial.

“The ‘big money’ is showing its head in Queenstown with private individual, iwi and corporate investment ratcheting up, and high-net-wealth Aucklanders particularly active.”

Knight Frank’s Global Buyer Survey showed the proportion of global buyers that are more likely to buy a ski home as a result of COVID-19’s impact increased from 11 percent in 2020 to 18 percent in 2021 with the desire for fresh air, views, opportunities for exercise, and the capacity to spend time with family and friends driving demand.

Buyers have been targeting mid-altitude resorts close to an international airport that offer a viable year-round base with a mix of activities on offer, access to reliable high-speed broadband, and with the potential to generate rental income – to at least cover maintenance costs.

Wallace says with the work-from-anywhere workforce expanding significantly during the pandemic and continuing today, ski resort town living has a shine to it.

“However, land is a finite resource and the pressure is on to meet unprecedented buyer demand for housing in the wider Otago Lakes region.”

The Ski Property Report 2022 also referenced that ski resort towns are exposed to climate change pressures, and with environmental, social and governance (ESG) factors rising up developers’ and investors’ agendas, leading global resorts and ski fields are investing heavily in implementable climate and energy action plans.

Wallace says it’s something New Zealand investors and operators will also be mindful of, with big player in the Queenstown market Ngāi Tahu Tourism, pledging to make all of its operations carbon neutral by 2050.

New Zealand context

With borders now open, our ski towns will be hell-bent on rebuilding tourism, strengthening relationships with key visitor markets, and optimising the winter window after two incredibly disrupted ski seasons.

The North Island’s central plateau ski field operators including Ruapehū, Whakapapa, Turoa and Tukino, and Canterbury’s ski fields including Mt Hutt, Porters, Broken River and Temple Basin have traditionally relied on the domestic market and have been fairly resilient throughout the pandemic – albeit with restrictions and handbrakes impacting bottom lines.

However, the Otago Lakes region has borne the brunt of pandemic stop-start dynamics, with Queenstown and Wānaka ski fields bereft of international skiers – particularly Australians – who traditionally bring millions of tourism dollars to the area.

With direct international flights into Queenstown back and with the government green-lighting entry to the country for 275 experienced ski industry workers, everything is crossed for a successful season.

Adventure capital

While the pandemic gutted Queenstown’s tourism sector, there is now a proactive push to diversify the local economy.

Extended lockdowns have motivated New Zealanders to future-proof options and invest in property in the ‘adventure capital of the world’, with a new appreciation for what Queenstown offers as an all-year-round destination.

The latest QV House Price Index showed Queenstown’s home values increased more this last quarter than any other main centre in New Zealand, with the average home value up 4.5 percent on the previous quarter to $1,666,755.

An identified housing shortage, strong interest from Australian and qualifying Asian buyers, a desire for a lifestyle change, the development of high-end gated communities and continued property acquisition by high-net-wealth individuals are driving prices, with premiums being achieved in the market.

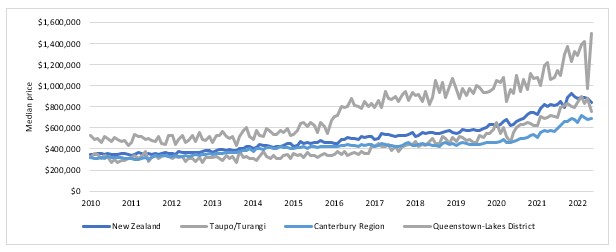

Median house price growth in New Zealand’s ski regions

Source: Real Estate Institute of New Zealand (REINZ)

Wallace says with a shortage of development land, existing sites are being optimised and multiple mixed-use developments with scale are progressing despite supply chain delays, rising building costs and staffing challenges.

“It’s clear that commercial and industrial property infrastructure needs to be robust to support the residential growth that’s being seen in the Queenstown area and growth fundamentals need to be addressed.

“Council is in catchup mode to balance upgrades to roading networks and beautification programmes in the town centre with the demand for housing, amenities and community services.”

With $60 million worth of council-led projects underway to refresh and future-proof downtown Queenstown, and with the Frankton area emerging as a dynamic commercial hub, investors are scoping opportunity.

Wallace says the commercial market is fairly constrained, with assets historically tightly held – but property values are holding strong when transacted.

“Commercial yields for A-grade assets remain strong – and the very low vacancy rates across all commercial sectors reveal a very tight market, which is in line with national trends – especially in the industrial space.

“Yields may start to soften as interest rates increase and we expect average rents to rise as new commercial stock comes on stream after COVID-related delays.”

Work is progressing on some of the delayed pipeline of work, and Wallace says the heightened demand for residential housing is driving change in the commercial sector footprint.

“While the majority of residential consents are still for standalone housing – largely around Jack’s Point and Hanleys farm – some commercial sites that were earmarked for further hotel development are being repurposed as high-density residential opportunities.

“Experienced hotel and apartment developer, Safari Group is progressing the $90 million Lakecrest apartment, penthouse and villa development on Queenstown Hill, and the yet-to-be-consented Taumata/Lakeview $1 billion development by a consortium including Ninety Four Feet, Centuria Capital, and Britomart Hospitality Group on the former Queenstown camping ground site, is planned to include three hotels and extensive commercial developments over 10 hectares.”

Also designed to address the town’s housing shortage, the first sections in the new 600-700-lot Silver Creek subdivision on 34 hectares of former farmland above Frankton Road are for sale, and Ngāi Tahu Property is underway with its master-planned Te Pā Tāhuna apartment complex in Gorge Road close to the town centre.

Wallace says the big investment in the commercial accommodation sector happened in 2019, with some new high-profile hotel operators only now starting to get into an international visitor market groove.

“Queenstown Airport Corporation notes forecast annual passenger numbers will increase from 1.11 million this year to 2.47 million in 2025 so the jury’s out on what additional visitor bed numbers will be required.

“This winter will challenge the resilience of the retail, hospitality and tourism sectors and while commercial accommodation occupancy levels are expected to rebound, Queenstown faces the perennial dilemma of adequately housing its seasonal workforce.

“Long-term rental inventory has plummeted as short-stay holiday accommodation models escalate, with accommodation manager Bachcare saying bookings in the region are up 114 percent on 2019.”

Given the overcooked local housing market, Wallace says conversations in the town suggest private equity is needed to build dedicated worker accommodation.

“It’s happening globally in ski resort towns, and universities around New Zealand have shown that a partnership accommodation model works and is financially viable.

“There’s an opportunity in Queenstown to tangibly add value to the local economy and take the pressure off a squeezed housing sector.”

In an innovative move, Wānaka Backpackers is partnering with Cardrona and Treble Cone ski fields to provide affordable, well-located staff accommodation this winter, utilising the old Base Backpackers on Brownston Street to house 120 staff.

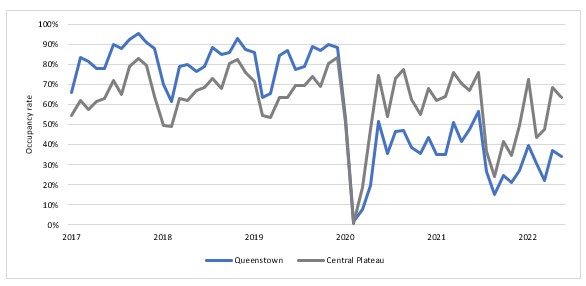

Hotel occupancy rates – Queenstown and Central Plateau

Source: Hotel Data New Zealand (HDNZ)

Read more market insights from Total Property

Subscribe to receive the latest commercial news and insights from Bayleys Total Property