Back to the future

We’ve been here before, and investors and tenants are taking supply chain delays and inflationary pressures in their stride as major developments kick off.

Total Property - Issue 5 2022

New Zealand has emerged from the darkness of COVID-19 lockdowns to discover another beast to tame – inflation hitting levels of 30 years ago.

The current 6.9 percent rate is on a par with 1990, although still relatively modest when compared with the tumultuous 1980s when inflation hit 17.6 percent.

A major difference when comparing the economy of the late 1980s to today is the unemployment rate. In the late 1980s it soared above 10 percent and took two decades to fall to the record low 3.2 percent unemployment of 2022, which continues to drive retail spending and property development.

Bayleys national director retail, Chris Beasleigh, is working with landlords and retail tenants eager to open for business at several new big developments.

They include Pinehill Central on Auckland’s North Shore, East Coast Heights further north at Silverdale, Ormiston Town Centre in South Auckland, and Timaru Showgrounds in the South Island.

“Anything in the suburbs or near a supermarket in growth areas is popular with developers and retailers. In Auckland around the edges of the city, and in high-spending places like Tauranga where there are more houses there is more retail spending. Part-working from home is still quite strong which boosts suburban shopping. Among the corporates, there is very much a three-day week with two days working from home.”

However, putting together deals is a different prospect from a few months ago thanks to COVID-related supply chain logjams and – inflation.

“There’s a double whammy at the retail end because of rising fitout costs for the retailer plus delays in materials when parts come from overseas.

“The biggest thing is making sure everyone works out the numbers and the construction costs. Costs used to be largely determined by the land but now it’s the inflationary construction costs.”

To save time developers are providing more of the shell fitout, Beasleigh says.

“It used to take about three months for a handover to the tenant from building consents stage; now people are looking at five months for handover. During that time the retailer can’t open, so it’s been a major hurdle.

“We explain to people before they develop what they need to do to mitigate problems so everyone knows from the beginning of a project. Sometimes it’s made deals harder to put together. For example, franchisees need to go to the bank and go through the approvals, and things are changing rapidly all the time.”

OVERCOMING HURDLES

Beasleigh says good designers and consultants make all the difference.

“There are a lot of boxes to tick and a lot of hurdles but we’re aware of them. We can tell the developer or retailer what’s happening and navigate them through it. We understand the difficulties and the issues and can give sound advice to get through it.”

One of the biggest changes is the way lease agreements are being structured.

“You can’t keep putting rents up as a percentage of turnover in the high inflationary environment currently. Hopefully, inflation is just spiking but we don’t know long it will last.

“Property owners are seeing inflation going up about seven percent and they want the same increase, but the retailer is seeing the cost of goods going up the same while they’re making the same amount of money.”

Beasleigh says the most common rental arrangements in recent years have been fixed-growth increases in the order of 2.5 percent to three percent, with market periodic reviews, or on renewal of the term.

This has given more certainty to both parties to the agreement. However, with consumer price index inflation now approaching seven percent, owners are keen to push towards this level of rental increase.

As a result, market reviews during the term of the lease are becoming more common as landlords and tenants negotiate flexible arrangements through their brokers.

“Over the past decades of low inflation, a fixed-cost increase was popular. However, now market reviews are coming back in greater favour to take account of where inflation is tracking in future during the term of a lease.

“It may not be achievable on a shorter-term lease but if it’s a 10-year lease it offers the chance to make adjustments in case inflation gets out of control, or the opposite.

“We’ve been having discussions like that in the past three months as things change quickly,” Beasleigh says.

The completion date for East Coast Heights neighbourhood centre at Silverdale adjacent to the soon-to-be-developed large format retail centre is mid-2024. Asking rentals are $450/sqm to $650/sqm, with flexible-designed spaces available.

Retail units at Pinehill Central on Greville Road on Auckland’s North Shore have become available with asking rentals from $500/sqm to $670/sqm or by negotiation.

The master-planned Ormiston Town Centre in South Auckland is spread over 1,700 hectares with a number of tenancy agreements already concluded.

Asking rentals at the Timaru Countdown and Bunnings-anchored mixed retail Showgrounds development are about $550/sqm.

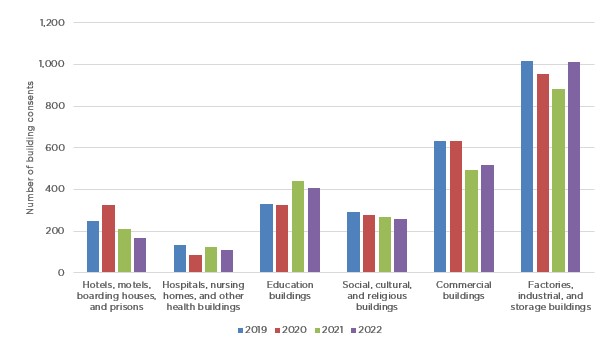

However, despite the difficulties faced by the construction industry, the major sectors of non-residential buildings still see a steady increase in the number of building consents, as reported by Statistics New Zealand.

The wider economy is also expected to gradually return to normal, leading to prosperity in multiple industries, such as travel, education and retail.

New Zealand building consents issued 2019-2022

Source: Statistics New Zealand

Read more market insights from Total Property

Subscribe to receive the latest commercial news and insights from Bayleys Total Property