House price hotspots

In a market where overall values have been steady for months, there are still pockets to be found where property prices are on the rise.

Recent housing market figures have confirmed a picture which is now well established: while property values nationally have grown solidly, sale prices in Auckland remain broadly stable.

Ongoing certainty in values has been a theme in the super city for two to three years now, with prices consolidating around the highs achieved following rapid rises in earlier years – albeit that buyers and sellers now do not always see eye-to-eye about where the value of a given home sits.

But, as anyone experienced with buying and selling property could tell you, citywide statistics will never give the full picture. Market activity and values can vary significantly from suburb to suburb, and street to street.

That is certainly the case in the current Auckland market. Within a market which, overall, is showing little movement there are still pockets where prices are clearly on the rise.

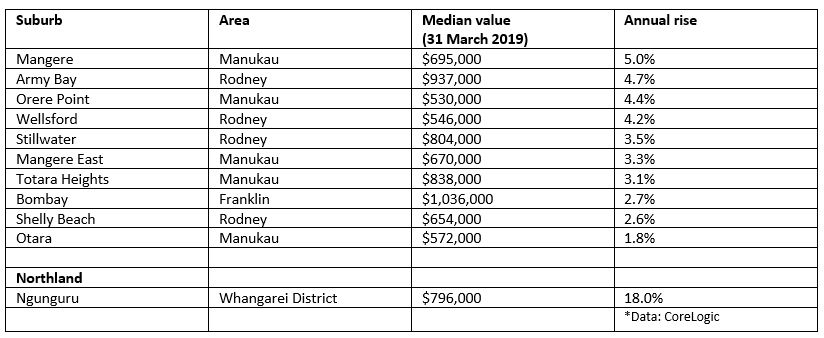

A suburb-by-suburb analysis of recent data from CoreLogic shows that the market is in fact a patchwork of hotter and cooler spots – and year-on-year capital gains of up to 5 percent are still on offer, if you know where to look.

At a broad-brush level, Manukau and Rodney have bucked the flatter trend with market strength relative to Auckland City and North Shore helping to lift local prices – a pattern driven in significant part by affordability and the return of first home buyers.

Manukau and Rodney accounted for nine of the 10 top-performing Auckland suburbs in the year to March. The suburb of Mangere leads the pack, with a 5 percent annual rise taking its median value to a still relatively affordable $695,000.

CoreLogic’s head of research Nick Goodall says Mangere’s rise is significant at a time when values across the city have drifted down by 1.5 percent. “Clearly there are still people willing and able to buy in a flat-to-dropping market. At the moment, Mangere is dominated by first-home buyers, with 48 percent of all sales in 2019 going to this group.”

Not far behind is Army Bay, in Rodney, whose median price was up 4.7 percent, to $937,000, with Orere Point (up 4.4%, to $530,000), Wellsford (up 4.2%, to $546,000) and Stillwater (up 3.5%, to $804,000) rounding out the top five.

Other locations where prices are on the rise include the Manukau suburbs of Mangere East, Totara Heights and Otara. Bombay, in Franklin, also makes the top 10 with its median price lifting 2.7 percent, to 1,036,000.

In Northland – a more affordable region with a markedly different market dynamic – continued solid price rises mean capital gains are easier to find. Though more recent signs point to a slowing in rapid value gains, the coastal settlement of Ngunguru, in Whangarei District, ranked 13th in CoreLogic’s national list of the top 50 performing suburbs, with an 18 percent annual hike in the median value, to $796,000. All 50 suburbs on the list saw annual rises of over 15 percent.

As with the fast-rising markets outside Auckland, affordability is a key driver in many parts of the super city, with most of the hotspots home to values well below the Auckland median – including Otara, Wellsford and Orere Point, whose medians of under $600,000 place them among Auckland’s most inexpensive locations. These prices are proving particularly attractive to first-home buyers.

According to the Reserve Bank, mortgage lending in April was $5.5 billion, up 1.4 percent from a year ago. Lending to first-home buyers, however, was up 11 percent, to $964 million.

The numbers suggest that the movements we’re seeing are down to affordability and the fact that there’s more activity in the first-home buyer segment of the market.

Together, these factors go a long way towards explaining why some suburbs are outperforming.

This focused demand has helped to drive market-leading price increases in these areas.

It is worth noting, though, that in some of the locations where prices are flat or have fallen slightly, one of the contributing factors is a change in the stock that’s been selling recently. There have been a lot of apartment transactions, which traditionally are at a lower price point than family homes, and can skew local medians.

What’s clear from the patchwork of strength in the market is that there are buyer opportunities to be found in all parts of the city. Affordability is driving demand and lifting prices in the hotspots – but stability or slight falls in prices elsewhere will present their own opportunities for buyers.

Wherever you are, thorough research of the local market remains the key to securing opportunities at an attractive price.

Read more...

[Download PDF]